The St Peter’s Finger is trading under Hall & Woodhouse’s Managed House division. Average sales are circa £21k per week. Consistent local wet & dry trade is boosted by strong tourist and visitor numbers all year round. The pub benefits from being in first class condition having undergone a major refurbishment in 2024.

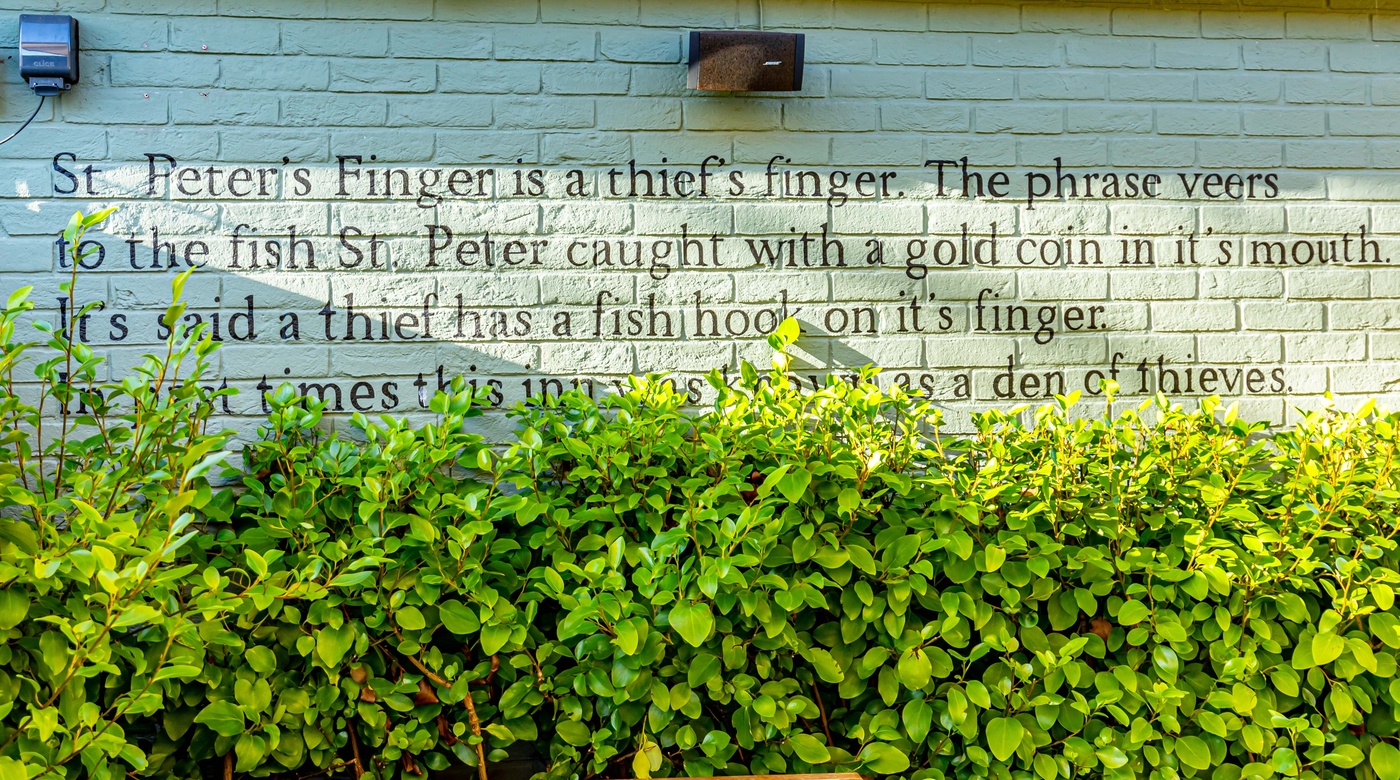

St Peter’s Finger

|

| Illustration of Year 1 Ingoings (excludes rent) | Net | VAT | Inc VAT | ||

| Deposit | £ 7,500 | N/A | £ 7,500 | ||

| Training Fee | £ 1,000 | £ 200 | £ 1,200 | ||

| Change of DPS | £ 254 | £ 46 | £ 300 | ||

| Digital Asset Fee | £ 250 | £ 50 | £ 300 | ||

| Working Capital*** | £10,000 | N/A | £10,000 | ||

| F&F (Outright Purchase Option A) | £68,800 | £13,760 | £82,560 | ||

| F&F (Purchase Agreement Option B) | £17,200 | £13.760 | £30,096 | ||

| Total Option A | £87,804 | £14,056 | £101,860 | ||

| Total Option B | £36,204 | £14,056 | £50,260 |

Additional Information

- Estimated Wet/Dry Split: 45%/55%

- Business Rates**** Payable: £28,392 pa

- Available From: Feb 2026

- Closing Date for Applications: 31/03/2026

E&OE

Trade

| Last 3 year Volume | Beer & Cider - HL | Wines - Litres | Spirits - Litres | Soft Drinks - Litres |

| Current Year | 303 (HL) | 4535 | 281 | 3910 |

| Last Year | 326 (HL) | 5192 | 290 | 4385 |

| 2 Years Previous | 296 (HL) | 4665 | 235 | 4150 |

Meet the Pub's Business Development Partner.....

“The ideal applicant will have great hospitality experience in high volume businesses where managing and motivating a team is crucial. The business has strong bar and food trade so the ability to create repeat business is key alongside the development of effective campaigns to attract those visiting the area”

Ian Pearson

Business Development Partner

Useful Links

British Institute of Innkeeping: https://www.bii.org/

British Beer and Pub Association: https://beerandpub.com/

Pre-Entry Awareness Training (PEAT): https://www.bii.org/BII/Industry-Advice/PEAT.aspx

Personal Licence: https://www.gov.uk/government/publications/personal-licence-application–2

Misrepresentation

*Fair Maintainable Trade (FMT):

FMT is the level of turnover and profit that we believe that the business is capable of delivering if being operated competently. The FMT is usually calculated by the Business Development Partner for the pub to rent, who will produce a shadow profit and loss account for the business which supports the rent. A copy of the shadow profit and loss account will be provided during the recruitment process.

Code of Practice:

Please see our Code of Practice for more information on FMT and rent. The Fair Maintainable Trade is not a guarantee of levels of trade or profit that will be made from the business – we strongly recommend you seek appropriate independent legal and business advice as part of your Business Plan.

**The Full Investment Breakdown:

The Full Investment Breakdown for each public house is higher than the minimum investment we will accept. This is because potential Business Partners with the minimum investment available can still be accepted as we are able to offer them financial support for the rest of the monies.

***Working Capital:

The working capital incorporates the purchase of stock, glassware, loose catering effects and valuer fees – please note the number quoted on this website are based on estimates. The exact costs will be determined on the day you take on the public house by independent valuers and stock takers. Please see our Code of Practice for more information about investment.

****Business Rates Payable:

This figure reflects the current multipliers for 2025/2026 and the 40% hospitality relief, effective until 31/03/2026.